Older people are better at investing.

That’s not a factual statement… and it’s not politically correct either.

But, it’s generally true.

Older people are better at investing because they have more perspective and experience.

Conversely, younger people do more stupid stuff.

That’s not a factual statement either… but it’s also generally true. And it also means that younger people are not very good investors.

It all has to do with lessons learned. Younger investors will make more mistakes, which will make them better investors as they get older.

Common sense.

And the same could be said for many other industries, as age often means wisdom.

Here’s something crazy to think about…

If you are a financial professional that went to work in the spring of 2009, then you have never lived through an economic downturn.

That means there are MANY financial professionals who are in their thirties who have never seen things go wrong.

Of course, they know the stories of the dot com bubble and the housing crisis… but hearing a story is much different than living though it.

Perhaps that’s the explanation for the sky-high valuations in many stocks today? Or maybe it’s just that many investors have forgotten what it’s like to lose money?

The lack of experience has fueled the market higher…

Although that might be partly true, the reality is that there are many other factors.

Most notably, the cyclical nature of the market is the best explanation for where we are at today.

Newton’s third law is: For every action, there is an equal and opposite reaction.

The 2008 stock market crash has been met with the bull market of the past 8 years.

And perhaps the bull market of the past 8 years will be met with an equal and opposite reaction… the stock market crash of 2018?

I’m not betting on it. There are too many outside forces (central banks) who can keep this market afloat for longer than we can bet.

But… there is something that I am willing to bet on. And its cyclical nature is glaringly obvious right now.

Commodities.

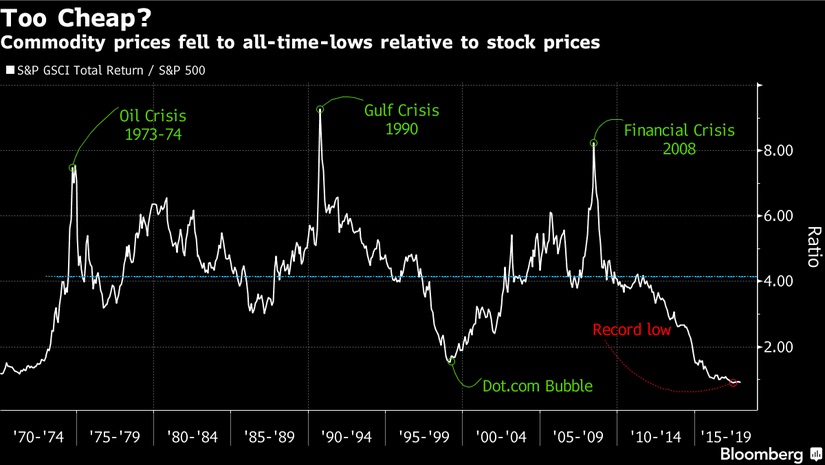

From that same Bloomberg article, “In 2008 stocks were screaming to be bought on this valuation metric, and that was proven correct,” Hackett said in a note to clients late Monday. “We now have the exact opposite condition where commodities are screaming to be bought at the expense of stocks.”

Just look at the Bloomberg Grains Sub-index:

As a young(er) investor, it’s hard to see the bigger picture here.

The stock market always goes up. And commodities always go down. Right?

Let’s turn to billionaire Sam Zell, who has consistently profited through ups AND downs in the market, to see what he thinks:

“I can’t explain the valuation of the big tech companies, and can’t believe that we won’t see a significant correction there. For example, in order to justify the multiple that Amazon trades at today, the company would have to be worth 25% of the US economy five years from now. This situation is no different from the one in 1997, when I pointed out that Cisco’s multiple would only be justifiable if the company represented 25% of the US economy five years later. Obviously, that didn’t happen, and I don’t think it’s going to happen with today’s big tech companies, either. I’m also generally concerned about the size, scale, and influence of these companies, which I think is out of hand and dangerous to our overall society. Absolute power corrupts absolutely, and these companies are being set up to do exactly that.”

If you know of Sam Zell, then you might be a little turned off.

The 76-year-old is on the Forbes billionaire list, and to say he is outspoken is an understatement. Frankly, he’s quite offensive.

But he’s also been overwhelmingly successful in noticing market trends and positioning himself to profit the most.

That’s why his comments on today’s market are particularly important.

“The most crowded areas are in technology, applications, “disruptions,” and all of the magic words that are driving people today. But the excitement over them doesn’t make them compelling. In many cases, I don’t think you’re getting paid for the risk involved—and the risk, by the way, may be unbridled competition. By contrast, I see opportunities in much more mundane areas. For example, we made a big investment this year in a trash-hauling business. We’re building waste-to-energy facilities. We’ve been buying refineries. We’re looking at agricultural investments. These are all assets that people value inappropriately, in my view. And, while perhaps less flashy than tech, that’s the kind of stuff that I’m always looking for.”

I whole heartedly agree with him here… especially his last three sentences.

That’s why we’ve been working on a new agriculture investment for the Explorer Partnership. More on that later… but here is a sneak photo:

There are also lots of ETFs out there that will give you exposure to the commodities space. The iPath Bloomberg ETFs $JJA and $JJG are two great choices.