I’ve got to admit… I don’t really want to share this with you.

It’s not because I’m embarrassed… it’s because I’m frustrated!

Just talking about this makes my blood pressure rise.

Have you ever been told you’re wrong, even though you know you’re right?

For example… Say you were driving down the road at 50 mph (km/h for you non-Americans) and then the police pull you over. The officer walks up to your window and says, “I just clocked you at 90 mph! That’s well over the speed limit.”

Meanwhile, you’re thinking to yourself, “I know for a fact that I was not going 90 mph… I was going 50!”

Then, you argue with the police officer and he ends up giving you a speeding ticket. You drive away thinking that you’re either going nuts or you just got bamboozled by the police officer.

Basically, you know you are right, but someone else says you’re wrong. And you pay for it.

Ok… here is where I made my mistake…

I made a trade on the VIX – the volatility index.

I looked at the historical average of where the index was during the month of August and I also looked at current events to gauge where the index was headed.

I placed a trade that I basically knew would fall in my favor.

But I was wrong.

At first, I thought I was going crazy because I didn’t understand where I made the huge mistake. (it wasn’t that huge, as the trade was small in dollar amount… but it still pissed me off!)

So, I started to do some research to see where I went wrong… and then I came across an article that you can check out here.

**Warning… this is super technical material, so if you don’t want to be bored or confused, just skip down to the last couple sentences.***

The only way to trade the VIX is by using ETFs, as the VIX is only an index. The ticker symbol “VXX” is the post popular trade… and that is what I was using.

So, I made the trade that I felt was going to be a for sure win… and then I was wrong.

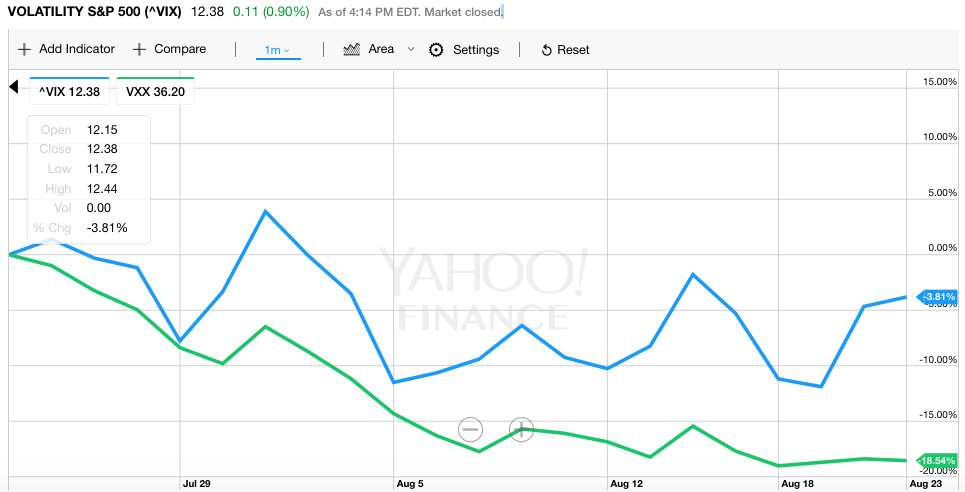

Take a look at this chart:  See how the VXX and VIX aren’t tracking each other, like they’re supposed to?

See how the VXX and VIX aren’t tracking each other, like they’re supposed to?

The VXX (the lower green line) should be tracking the VIX (the upper blue line)… because the VXX didn’t track the VIX, my trade went wrong. You can see the last little spike of the blue line, as the green line just stays flat.

Well, that’s how I made a bad trade. It wasn’t my fault… except it was. I should have known that this would happen. I have now learned.

In a nutshell, what happened (and is still happening) is that the ability to trade the VIX is broken. When traders take long positions in a VIX trade, the actual index itself gets depressed, which is counterintuitive to what the trade is supposed to profit from in the first place.

Russel Clark, who authored the linked article says it best:

“The VIX ETFs were set up to mimic the movement in VIX. However their success has led them to exert an influence on the market they are meant to mimic. To my mind it makes the VIX a poor indicator, as when nervous investors buy VIX ETFs they actually push down the VIX, and confident investors who are short VIX ETFs encourage it to spike. Given that VIX measures often are used to guide the risk that algorithms can take, this seems very contradictory to me. I would use extreme caution when using the VIX as part of any investment process.”

So my recommendation to you is, do not trade the VIX.

While this was very frustrating to me, I found that this is one more broken sector of the market to stay away from.

Sometimes learning things NOT to do are just as important as learning things TO do.

Also… there is one bit of news that has been eclipsed from the media lately. It has to do with the 6th largest economy in the world – California. If you want a preview, read this. I’ll have more this week.